Payroll is an essential part of managing a small business. Not only do your employees have to get paid on time, but your company must also comply with local, state and federal regulations. If you’re looking for payroll services to help your business, this list of best payroll services can help.

Why Does a Small Business Need Payroll Services?

Enrolling in a payroll service platform allows you to focus on your core business, instead of performing tasks that don’t contribute to its growth. In many instances, payroll services are less expensive than hiring full-time human resources professionals.

What is the Difference Between a Full-Service and Standard Payroll Service?

Standard payroll features include:

- Filing tax forms

- Payroll processing and direct deposit

- Pay stubs for employees

- Payroll tax payments

Full-service payroll features include:

- Onboarding support for your employees

- Employee recruitment

- Health insurance

Many of the best payroll services for small businesses offer standard and full-service features. Depending on the size of your business, you may only need one payroll service.

Nice-to-Have Features When Looking for a Payroll Service Provider

As you review the features of the best payroll services, you should be aware of the nice-to-have features. Pricing is important when selecting a payroll service; however, you’ll want to consider certain features to help you operate your small business.

Nice-to-have features for best payroll services for small businesses include:

- Unlimited payrolls

- Mobile app

- Year-end tax reports

- Third-party add-ons

- PTO tracking

- Online payroll

- General ledger integration

The Best Payroll Services for Small Business Owners

Think about your small business needs. What payroll features would enhance your daily operations? Select a payroll provider that offers essential features for your business at an affordable price.

- 1. Gusto

- 2. Quickbooks Online Payroll (QBOP)

- 3. Intuit Online Payroll (IOP)

- 4. Square Payroll

- 5. OnPay

- 6. Namely

- 7. Sage Payroll

- 8. Paychex Flex

- 9. RUN by ADP

- 10. SurePayroll

- 11. Wagepoint

- 12. Xero

- 13. PayCor Perform

- 14. PrimePay

- 15. Paylocity

- 16. Big Fish Payroll Services

- 17. IOIPay

- 18. CBIZ Flex-Pay Payroll Services

- 19. Client Solutions Group

- 20. Optimum Employer Solutions

- 21. PaySmart

- 22. Premier Payroll Services

- 23. Integrated Payroll Services (IPS)

- 24. Jumpstart: HR

- 25. Diamond Payroll

- 26. Emplloy

- 27. Checkmate Payroll

- 28. DM Payroll Services

- 29. PayUSA

- 30. MyPayrollHR

- 31. Heartland Payroll

- 32. TriNet

- 33. Justworks

- 34. Fuse Workforce Management

- 35. Precision Payroll of America

- 36. Pro iPay

- 37. TelePayroll

- 38. Advantage Payroll Services

- 39. Kelly Payroll

- 40. Coastal Human Resource Group

- 41. PayLumina

- 42. AmCheck

- 43. Automatic Payroll Systems (APS)

- 44. Newtek

- 45. Harpers Payroll Services

- 46. Insperity

- 47. JetPay

- 48. MMC HR

- 49. Oasis Outsourcing

- 50. High Flyer HR

- 51. Fingercheck

- 52. Wave

- 53. BenefitMall

- 54. Patriot Software

- 55. SurePayroll

- 56. OperationsInc

- 57. Zenefits

- 58. Dayforce HCM

- 59. Paybooks

- 60. HRAPP

- 61. Keka HR

- 62. Kronos Workforce Ready

- 63. Comprehensive Payroll Company

- 64. Microkeeper

- 65. Kevit

1. Gusto

Formerly known as ZenPayroll, Gusto is trusted by HVAC and other home services companies and self-employed technicians. This full-service system integrates with third-party accounting software, time-tracking software, and benefits admin software.

- Core – $39/month

- Complete – $39/month plus $12/month per employee

- Concierge – $149/month plus $12/month per employee

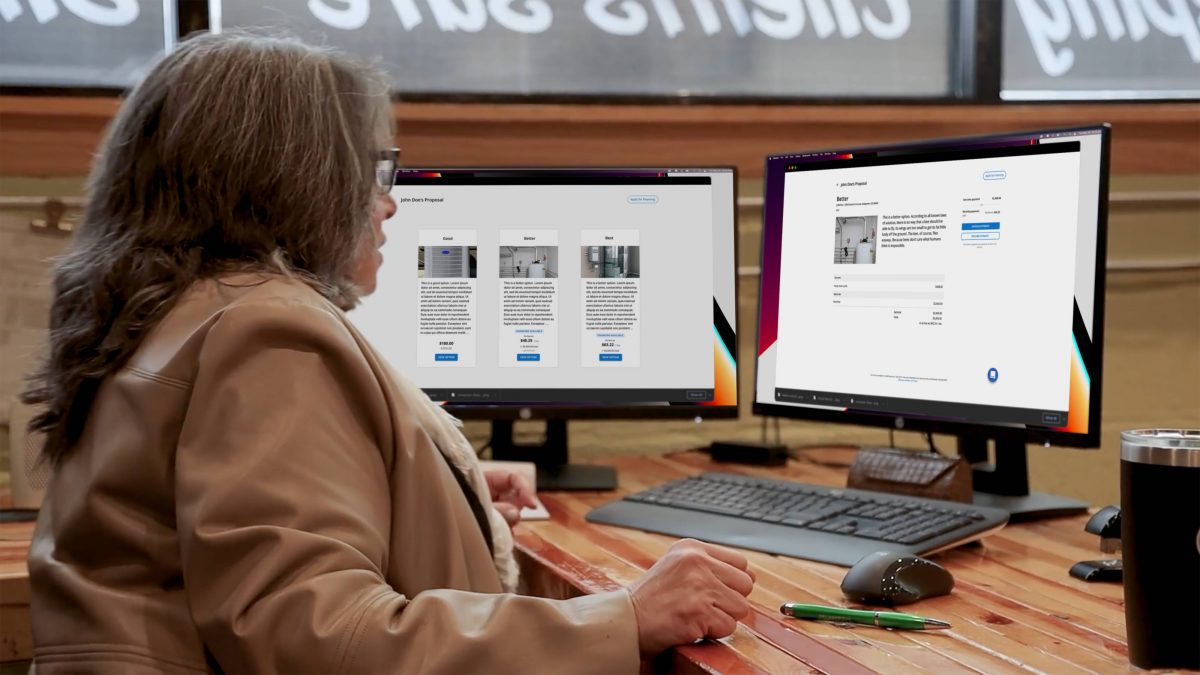

Gusto integrates with Housecall Pro, the all-in-one solution to help home service businesses handle dispatching/payment/other business operations, to automatically sync technician timecards from Housecall Pro to Gusto for not just payroll, but also automatic taxes and more.

Tips for Home Service Business: What a Payroll Period Looks Like

If you’re wondering how other home service businesses handle the weekly payroll period for their techs, let’s hear some tips from Housecall Pro’s Facebook community of home service professionals:

“We pay weekly, Monday to Sundays, and it works for our techs” – Toni Ann Russell, Home Comfort Solutions

“Week is Mon-Sun, and we pay on the 15th (for prior month’s time 16th thru last day) and last day (for current month time 1st-15th) of each month.” Elizabeth Minor, Excelsior Air

“Monday – Saturday. Time cards turned in by noon on Wednesday, and payday is on Friday. I will only do payroll once a week… No time card, no paycheck, no exceptions!” – Lindsey Brown Martin, AC Doctors

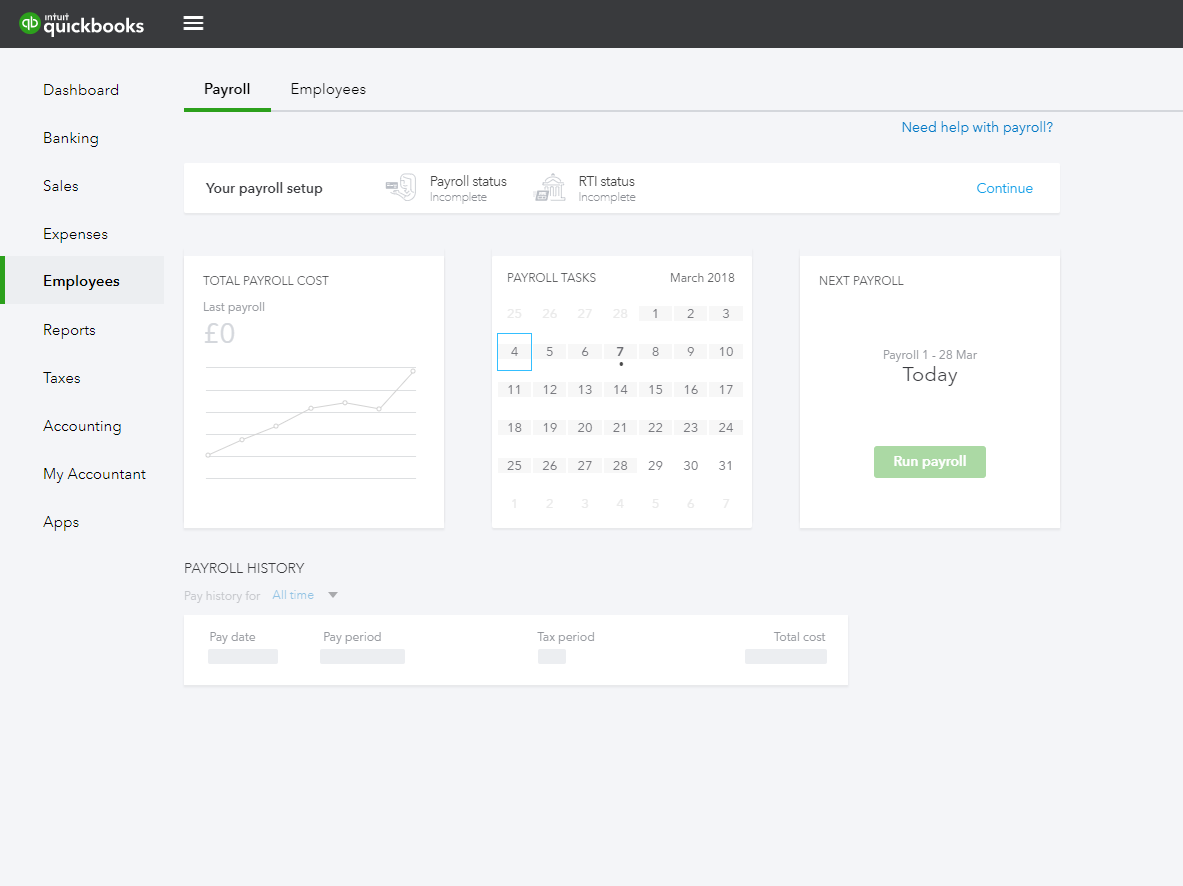

2. Quickbooks Online Payroll (QBOP)

Quickbooks Online Payroll is an affordable and popular payroll service. Basic features include payroll tax computation, unlimited payroll runs, paycheck calculations, and direct deposit. This software integrates with Housecall Pro and other third-party apps.

- Basic – $29/month plus $2/employee

- Enhanced – $45/month plus $2/employee

- Full Service – $80/month plus $4/employee

3. Intuit Online Payroll (IOP)

Benefits of IOP include access to a full-service payroll solution, fast payroll runs, and online employee self-service solutions.

- Self Service – $17.50/month plus $4/employee/month

- Full Service – $40/month plus $4/employee/month

- Self Service (Quickbooks) – $30/month plus $4/employee/month

- Self Service (QuickBooks Plus) – $52/month plus $4/employee/month

- Full Service (Quickbooks) – $53/month plus $4/employee/month

- Full Service (Quickbooks Plus) – $75/month plus $4/employee/month

4. Square Payroll

Square Payroll offers user-friendly features and affordability. Key payroll solutions include tax calculations, flexible pricing, W-2 generation, automated federal tax payments, online employee accounts, direct deposit, and benefit deductions.

- Contractors Only – $5/contractor per month

- Employees and Contractors (Full Service Plan) – $29/month plus $5 per employee/contractor

5. OnPay

OnPay is a full-service payroll software that offers payroll processing speed and accuracy. Key features include payroll runs in all states, W-2/1099 processing, direct deposit, guarantee tax filing, unlimited payroll processing, debit card/check payments, and phone support. OnPay costs $36/month plus $4/employee. Try out the first month for free.

6. Namely

Namely is known as the HR software for humans. This full-service payroll software keeps track of all HR, benefits, and time data. Payroll features include year-end reporting, compliance, ACA reporting, employee access, and simple tax filings. For pricing information, schedule a demo and speak with a company representative.

7. Sage Payroll

Sage is attractive to companies because it’s easy to use, customizable, secure, and packed with useful features. Payroll features include time/attendance, PC/Mac compatibility, and tax computations.

- Sage Payroll Essentials – $49.95/month

- Sage Payroll Full Service – Request a quote from the company

8. Paychex Flex

Paycheck Flex includes easy import/export capabilities and payroll reminders. This software is designed to accommodate the needs of businesses with 1 to 49 employees. Paychex Flex offers payroll safeguards, employee access, and a free mobile app. Customer service is available 24/7. Contact the company for Paychex Flex pricing information.

9. RUN by ADP

Run by ADP is popular among bookkeepers and accountants of small businesses. Features include print/mail paychecks, automatic wage garnishment payment services, time/attendance, payroll delivery, direct deposit, tax forms (1099s and W-2s), and check security. Plans are Essential, Enhanced, Complete/HR Plus, and HR Pro Payroll/HR. Contact Run by ADP for pricing.

10. SurePayroll

Sure Payroll offers a full-service payroll solution for small businesses. Key features include federal/state/local payroll tax filings, two-day standard processing, automatic payroll, workers’ compensation, 401(k) plans, health insurance, and pre-employment screening. To get a quote, contact SurePayroll to speak with a representative.

11. Wagepoint

Wagepoint is a full-service payroll solution that takes care of complicated HR tasks for your business. Software features include wage report details, federal/local/state payroll taxes, contractor payments, year-end reporting, and online pay stubs. The cost of Wagepoint is $20 plus $2/employee. Wagepoint doesn’t charge setup fees.

12. Xero

Xero payroll services save time and money. Key features include real-time cash flow monitoring, invoicing/quotes, payroll tax calculations, single-touch payroll solutions, and inventory management.

- Single Touch Payroll (1 to 4 employees) – $10/month

- Starter – $25/month

- Standard – $50/month

- Premium 5 (Full Service) – $65/month

13. PayCor Perform

PayCor Perform is a human capital management platform that includes applicant tracking software, onboarding solutions, full-service payroll systems, tax compliance, general ledger integration, workforce insights, and employee self-service solutions. For Paycor Perform’s pricing details and a product demo, go to their website to fill out a form.

14. PrimePay

PrimePay’s key features include insurance/compliance, merchant services, benefit services, an all-inclusive payroll (federal/state/local tax withholdings and W2 filings), time clock, and HR solutions. Software pricing is based on your area and the number of employees. Use the PrimePay payroll calculator to estimate your costs.

15. Paylocity

Paylocity is a user-friendly payroll solution that provides quick-edit templates, custom checklists, employee action forms, data integration, multiple payroll reports, integrated expense management, and payroll tax compliance. For pricing, visit the Paylocity’s website.

16. Big Fish Payroll Services

Big Fish Payroll Services provides time tracking, payroll reports, comprehensive tax management, workers’ compensation, pay cards, and direct deposit. For plan quotes, complete a contact form on the Big Fish Payroll Services’ website.

17. IOIPay

IOIPay is an ideal payroll processing system for new businesses. This software offers all-in-one solutions that include reporting/compliance, workforce management, HR management, and cloud-based payroll. Software pricing depends on the number of employees and services. Submit a contact form on their website for pricing information.

18. CBIZ Flex-Pay Payroll Services

CBIZ Flex-Pay Payroll helps clients save time and money with its accurate payroll software system. This company provides responsive customer support, time/attendance solutions, human resources tracking, and Section 125 administration. For a quote, contact CBIZ Flex-Pay.

19. Client Solutions Group

Client Solutions Group is an online payroll service solution. This full-service payroll processor includes retirement planning, workers’ compensation, partner payroll, time/attendance, and bookkeeping. Contact Client Solutions Group Payroll Services for a customized payroll plan quote and product demo.

20. Optimum Employer Solutions

Optimum Employer Solutions offers payroll solutions for small and medium-sized businesses. Key payroll solutions include paid time off tracking, payroll tax filing, direct deposit, paper checks, online payroll processing, W-2 preparation/mailing, time/attendance, job cost estimates, and employee/manager web portals. For pricing information, contact Optimum Employer Solutions.

21. PaySmart

PaySmart gives small businesses the ability to initiate and manage recurring payroll processing. Key features of PaySmart include tax filing, direct deposits, background checks, employee onboarding, paperless reports, workers’ compensation, tax payment services, and online payroll entry. Contact PaySmart for pricing information.

22. Premier Payroll Services

Premier Payroll Services saves businesses money, stress, and time. Features of this online payroll service include employee self-service solutions, quarterly tax returns, electronic reports, direct deposit, wage garnishments, onboarding, HRIS, labor distribution, 401K plan administration, online access 24/7 and vendor checks. For pricing information, contact Premier Payroll Services.

23. Integrated Payroll Services (IPS)

Integrated Payroll Services offers historical payroll records and customized payroll reports. This full-service payroll service provides talent acquisition services, time/attendance, benefits administration, and payroll services. Payroll service features include wage garnishment management, payroll reporting tools, year-end W2 processing, and automated tax filings. For a quote, contact Integrated Payroll Services.

24. Jumpstart: HR

Jumpstart: HR is more than payroll processing. This service includes human resources solutions, background checks, and payroll management. Additional services include pre-employment, employee onboarding and strategic human resources management. For a customized quote, contact Jumpstart: HR.

25. Diamond Payroll

Diamond Payroll is ideal for contractors and small businesses. Services include payroll check preparation, pay cards, direct deposits, deduction reports, year-end tax form preparation, state withholding reports, compliance, and wage garnishment processing. For pricing information, contact Diamond Payroll Services.

26. Emplloy

Emplloy provides full-service payroll solutions including multiple pay rates/schedules, unlimited payroll runs, direct deposits, federal/local/state taxes, 1099s, W-2s, online employee setup, and digital pay stubs.

- Payroll Basic – $40 base fee plus $6/month/employee

- Payroll Plus – $40 base fee plus $15/month/employee

- Enterprise – customized pricing

27. Checkmate Payroll

Checkmate Payroll is your partner for time tracking, payroll processing, and HR administration. Payroll solutions include direct deposits, payroll alerts, labor/distribution, calculations as you go, change history reporting, benefits/insurance management, workers’ compensation, benefits accrual management, and year-end tax filings. Request a quote on the Checkmate Payroll website.

28. DM Payroll Services

DM Payroll Services offers payroll management solutions for small businesses in a variety of industries including wage garnishments, Affordable Care Act compliance, workers’ compensation reporting, W2 compliance, employee self-service, certified payroll reports, time-off requests, standard reports, and employee earnings records. To request a quote, contact DM Payroll Services.

29. PayUSA

Small businesses partner with PayUSA because it offers flexible payroll processing and allows for payroll add-ons. Payroll services include direct deposit, pay cards, payroll tax filings, wage garnishments, cloud-based data servers, and 24/7 accessibility. Additional services include human resources administration, time/attendance, benefits, and onboarding. Contact PayUSA for a customized quote.

30. MyPayrollHR

MyPayrollHR offers noteworthy payroll solutions for small businesses. Not only does MyPayrollHR provide self-service portals for employees, but they also offer support for business owners. Features include tax compliance, payroll administration, direct deposit, paper checks, pay cards, and flexible services. To schedule a demo or get pricing, contact MyPayrollHR.

31. Heartland Payroll

Heartland Payroll offers flexible payroll options, competitive pricing, security, and a single point of contact. Features include paid time off management, labor report generation, POS platforms, workers’ compensation, multiple payment options, management reporting, an onboarding system, and an applicant tracking system. For pricing details, submit a contact form on Heartland Payroll’s website.

32. TriNet

TriNet payroll services save time and keep companies in compliance. This flexible solution streamlines payroll systems, so you can focus on what matters most to your business. Services include W-2 preparation, paid time off tracking, and electronic tax withholdings. TriNet’s pricing is customized for each business. For pricing, contact TriNet.

33. Justworks

Justworks is a full-service HR and payroll system. Software features include payroll tax filings, automated deposits, one-off payments, payroll tax compliance, and domestic contractor payments. This software works with Xero and QuickBooks.

- Basic – $44/month/ employee

- Plus – $89/month/ employee

34. Fuse Workforce Management

Fuse Workforce Management is a cloud-based human capital management and payroll system. This system includes ACA management, scheduling, time/attendance management, payroll, Core HRm and analytics. With Fuse Workforce Management, you have the ability to customize your payroll system to meet your company’s needs. For pricing details, contact Fuse Workforce Management.

35. Precision Payroll of America

Precision Payroll of America is a full-service payroll provider. Basic features include online entries, payroll reports, annual tax report filings, and tax form preparation (1099 and W-2 forms). Optional payroll features are wage garnishment payments, pay-as-you-go workers’ compensation, and employee self-service solutions. To get a quote, contact Precision Payroll of America.

36. Pro iPay

Pro iPay is a full-service payroll, human resource administration, and time/attendance platform. Features include real-time payroll processing, a single sign-on platform, paperless payroll, direct deposit, payroll debit cards, electronic delivery, employee self-service tax management, and payroll alerts. For pricing details and a demo, contact Pro iPay.

37. TelePayroll

TelePayroll has recently merged with Asure Software to bring small businesses the highest quality in payroll services. This full-service software platform includes human capital management, asset management, time/attendance, payroll/tax management, talent management, benefits administration, and tax compliance. To schedule a live demo and learn about pricing, contact Asure Software (TelePayroll).

38. Advantage Payroll Services

Advantage Payroll Services is a great solution for small businesses that are growing. This full-service payroll solution includes new hire reporting, online portals, secure data management, tax filings, workers compensation administration, management reports, and instant payroll services. For pricing information, contact Advantage Payroll Solutions.

39. Kelly Payroll

Kelly Payroll is a full-service platform that is designed for businesses of all sizes. As your business grows, it’s easy to incorporate additional payroll tools. Payroll and Human Resources solutions include tax compliance, payroll deductions, benefits administration, employee onboarding, performance management, and workers compensation. Contact Kelly Payroll for quotes and a demo.

40. Coastal Human Resource Group

Coastal Human Resource Group offers outsourcing services for small to medium-sized businesses. Comprehensive services include compliance screening, pay-as-you-go workers’ compensation, payroll, time/attendance, tax filings, and online employee portals. To schedule a demo or get a quote, contact Coastal Human Resource Group.

41. PayLumina

PayLumina is an online payroll solution for small businesses. This system offers an array of services including time/attendance, self-service options for employees, tax compliance, tax filings, workers’ compensation, human resources management, and seasonal employee payments. For pricing and product information, contact PayNW.

42. AmCheck

AmCheck offers cloud-based payroll services with 24/7 customer support. You can ntegrate AmCheck with third-party accounting software. Key features of this full-service payroll solution include payroll administration, benefits administration, time management, workers’ compensation, tax compliance, and reporting. For a product demo and pricing, contact AmCheck.

43. Automatic Payroll Systems (APS)

APS is a cloud-based payroll solution that gives you access to your payroll from your smartphone, tablet, or computer. Key features include accurate pay, tax compliance, self-service, real-time reports, and analytics. To get a quote, contact Automatic Payroll Systems.

44. Newtek

Newtek offers a comprehensive list of human resources and payroll tools. This service includes online pay stubs, workers’ compensation, tax compliance, year-end reports, payroll account reviews, and payroll administration. Newtek provides all the tools you need to manage your team’s payroll and benefits. Contact NewTek to get a quote and demo.

45. Harpers Payroll Services

Harpers Payroll Services offers a suite of full-service payroll, HR, and tax compliance services. Payroll features include gross to net calculations, direct deposits, workers’ compensation, paperless payroll, and automatic checks. To request information or get a quote, contact Harpers Payroll Services.

46. Insperity

Insperity offers powerful full-service HR solutions for small businesses. Payroll and HR solutions include employee benefits, human resources administration, tax forms (W-2 and W-4), wage garnishment features, risk management, deduction administration, talent management, and employment verification. To get a quote or schedule a live demo, contact Insperity.

47. JetPay

JetPay handles all the payroll and human resources needs for small businesses. The benefits of using JetPay include security and dedicated HR support. Features include regulatory compliance, payroll, tax assistance, talent management, and benefits/compensation. To get a customized payroll service quote, contact JetPay.

48. MMC HR

MMCC HR is a top solution for human resources and payroll for small businesses. This company provides individualized packages for each company. Services include tax compliance, workers’ compensation, tax compliance, wage garnishments, regulatory compliance, and a dedicated support team. To schedule a demo or get pricing, contact MMC HR.

49. Oasis Outsourcing

Outsource your small business payroll to a company that streamlines human resources and payroll. Oasis Outsourcing is a full-service company offers resources that allow you to manage tax compliance, workers’ compensation, year-end document preparation, tax form preparation (1099, W-2 and W-4), and employee self-service. For a quote or demo, contact Oasis Outsourcing.

50. High Flyer HR

High Flyer HR is a trusted payroll services provider for small businesses. Services include PTO accrual management, standard compliance reports, automated deposits, direct deposits, onboarding, human resources consulting, and accounting software integration. Contact High Flyer HR for a pricing quote.

51. Fingercheck

Fingercheck includes employee self-onboarding, payroll, benefits/insurance, automated deposits, direct deposits, and HR administration.

- Time Clock Software – $3/employee/month ($20 subscription fee)

- All-in-One HR Platform – $8/month/employee ($39 subscription fee)

52. Wave

Wave’s user-friendly payroll services streamline employee and contractor payments. Features include year-end tax form preparation, automatic payroll filings, payroll service migration, and 1099/W-2 form preparation.

- Tax Service States – $35/month plus $4/employee/independent contractor (CA, FL, NY, TX, IL, WA)

- Self-Service States – $20/month plus $4/employee/independent contractor

53. BenefitMall

BenefitMall is a full-service payroll and tax compliance provider. Payroll service benefits include 24/7 support, mobile payroll services, and tax form preparation. For a quote, contact BenefitMall.

54. Patriot Software

Patriot Software offers simplified payroll solutions for businesses with up to 100 employees. Features include an online cloud-based platform, user-friendly software, and guaranteed security.

- Basic Payroll – $10.00/month

- Full-Service Payroll – $30.00/month

55. SurePayroll

SurePayroll is a full-service company. Services include pay-as-you-go workers’ compensation, 401K retirement plants, pre-employment screening, and compliance. Request a customized quote from SurePayroll.

- Basic – $44/month/employee

- Plus – $89/month/employee

56. OperationsInc

OperationsInc provides talent acquisition, payroll, and HR services. Payroll administration features include pay-per-use services, third-party integrations, payroll tax compliance, and payments. Contact OperationsInc for a quote.

57. Zenefits

Reduce errors and streamline your payroll platform with Zenefits. Features include time tracking, automatic salary changes, benefit deductions, and payroll reminders.

- Essentials – $8/month/employee

- Growth – $14/month/employee

- Zen – $21/month/employee

58. Dayforce HCM

Benefits of using Dayforce HCM include payroll data tracking, tax compliance, employee self-service, simple reporting, and quick data entry. Book a demo with a representative for information about pricing.

59. Paybooks

Paybooks is an all-inclusive payroll and HR system. Features include direct deposit, tax compliance, time/attendance management, and payroll analytics.

- Regular Plan – $1800

- Premium Plan – $3000

60. HRAPP

HRAPP services include time/attendance management, payroll analytics, simple pricing, tax compliance, and direct deposit.

- Lite Plan – $250/month

- Pro Plan – $500/month

- Enterprise Plan – $700/month

61. Keka HR

Keka HR is a full-service payroll software platform. Features include payroll processing, talent management, time/attendance, employee onboarding, tax compliance, and direct deposit.

- Foundation – $4999/month

- Strength – $6999/month

- Growth – $9999/month

62. Kronos Workforce Ready

Kronos Workforce Ready is a cloud-based system that integrates payroll, HR, talent, employee self-service, and workforce management. To schedule a demo and get pricing, contact Kronos Workforce Ready.

63. Comprehensive Payroll Company

Comprehensive Payroll Company is a reputable payroll services and HR provider for small businesses. Key services include standard compliance reports, automated deposits, direct deposits, onboarding, human resources consulting, and accounting software integration. Contact Comprehensive Payroll Company for a pricing quote.

64. Microkeeper

Microkeeper is trusted by small businesses throughout the world. Payroll and HR services include workers’ compensation, wage garnishments, PTO accrual management, standard compliance reports, automated deposits, direct deposits, onboarding, human resources consulting, and accounting software integration. Contact Microkeeper for a pricing quote.

65. Kevit

Kevit is a top payroll and human resources provider for small businesses. Services include PTO accrual management, standard compliance reports, automated deposits, direct deposits, employee onboarding, and third-party software integration. Contact Kevit for a pricing quote.

Rely on these best payroll services to help run your business more efficiently. You want a payroll software with features that match with your business’s needs. If possible, demo the product before you make a final decision. That way, you can focus on growing your small business.

![- Housecall Pro How to Write an Invoice Guide With Steps [+Free Template!]](https://www.housecallpro-qa.com/wp-content/uploads/2024/06/Small-business-invoice-Template-aspect-ratio-1200-794.webp)